Cryptocurrencies such as Bitcoin and Ethereum have trading characteristics that differ significantly from traditional financial markets like FX (foreign exchange trading) and stock trading due to their unique properties. This article focuses on those different characteristics and explains why cryptocurrency trading differs from other markets.

※ I’ve been using TradingView for chart analysis for over 6 years. It’s an industry-standard tool that’s basically free. It’s also widely adopted by securities companies and exchanges.

Market Trading Hours are Different

FX and stock markets have restrictions on specific trading hours. For example, stock markets typically operate during weekday business hours. In contrast, cryptocurrency markets allow trading 24 hours a day, 365 days a year. This means trading can be conducted anytime, anywhere.

Benefits of This Characteristic

- Expanded trading hours make it easier for traders from different countries and regions to participate.

- The ability to react immediately to events and news occurring worldwide makes market fluctuations faster.

Bitcoin Has Many Unique Indicators

Bitcoin and other cryptocurrencies have many unique indicators that don’t exist in traditional financial markets. These indicators are developed based on blockchain technology and cryptocurrency characteristics, incorporating elements not considered in traditional financial markets.

For example, looking at the list of indicators focused on BTCUSD posted on TradingView, you can see many unique indicators and analyses not seen in traditional financial markets.

Many users in the cryptocurrency community develop and share their own indicators and analytical methods. This allows traders to utilize information and analytical methods not available in traditional financial markets.

(Image: Bitcoin Limited Growth Model)

Charts are Different

Different trading hours also affect how charts are constructed. While traditional markets had artificially set trading time divisions, cryptocurrency markets remove these, tending to more naturally reflect physical and mechanical actions.

Benefits of This Characteristic

- Charts become smoother, making trends and patterns more clearly observable.

- With fewer artificial time constraints, trend changes and important support/resistance movements are more naturally reflected.

Trading is Easier

Cryptocurrency markets provide an environment where statistical methods from financial engineering and time-series data analysis are easily applicable. This makes it easier for traders to use more indicators and analytical methods.

Benefits of This Characteristic

- Traders can use advanced analytical methods to predict market trends more accurately.

- Trading in cryptocurrency markets enables approaches to new financial products and expands room for building unique strategies.

Automated Trading is Also Easier

Automated trading (algorithmic trading/automated trading/bot trading) is a method that automatically executes trades through programs. Bitcoin and other cryptocurrency markets have many exchanges that provide APIs, creating an environment conducive to automated trading.

(Image: Session Breakout Scalper Trading Bot)

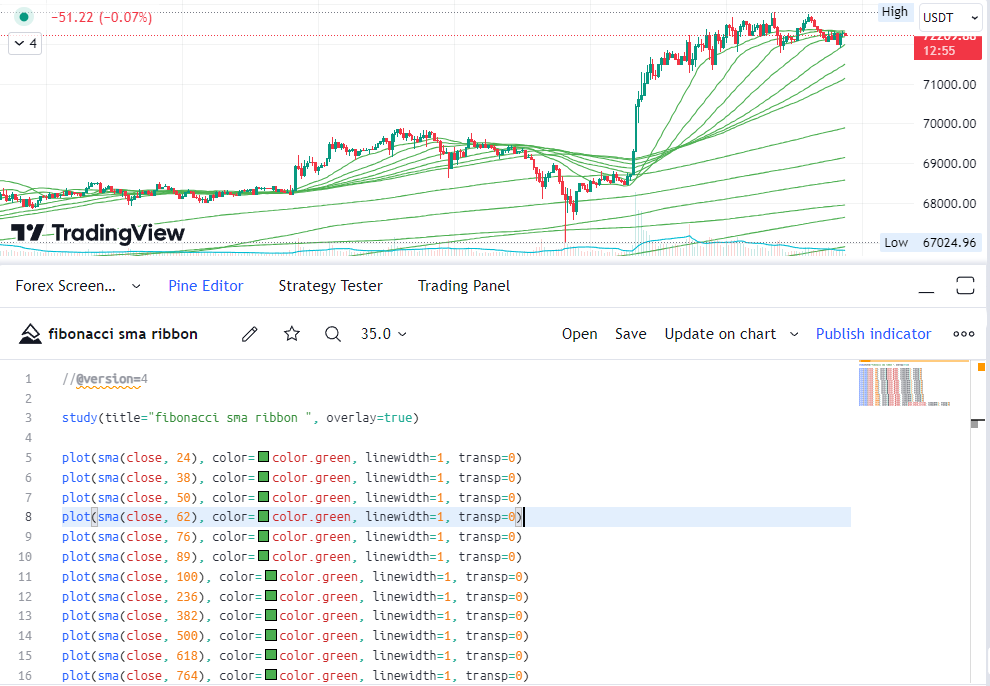

TradingView allows you to create scripts for automated trading using Pine Script, a proprietary programming (scripting) language. Pine Script enables programming of trading algorithms for automated trading, as well as backtesting and displaying indicators and alerts on charts.

- Pine Script® language reference manual (English)

- Pine Script® Language Reference Manual (Japanese)

(Image: Fibonacci Ribbon)

Risks and Challenges

Trading Bitcoin and other cryptocurrencies has different risks and challenges compared to traditional financial markets. For example, low market liquidity and susceptibility to sharp price fluctuations can be noted. Additionally, security issues and impacts from regulatory changes must be considered.

Summary

Trading Bitcoin and other cryptocurrencies has different characteristics from traditional financial markets in terms of trading hours, chart formation, and ease of trading. These characteristics provide traders with new opportunities while also presenting unique risks and challenges. Thorough understanding and careful approach are essential.